Getting quality sleep while you are experiencing financial stress can be hard to accomplish. The COVID-19 pandemic has put increased strain on many Americans’ wallets, making it more difficult to achieve sufficient sleep.

In this article, I’ll discuss a 2021 study that examined folks’ financial stress before and after the pandemic. Next, I’ll explore how financial stress impacts sleep. Finally, I’ll provide some expert tips for reducing your financial stress, so you can sleep better.

Note: The content on Sleepopolis is meant to be informative in nature, but it shouldn’t take the place of medical advice and supervision from your healthcare provider. If you feel you may be suffering from any sleep disorder or medical condition, please see a trained medical professional. Additionally, we are not financial experts, so you should not take any of this as financial advice. Please speak with a financial professional for any financially related questions.

The Research/Study

A 2021 report by the Global Financial Literacy Excellence Center (GFLEC) sought to understand the financial stress that was present in Americans’ lives before and during the COVID-19 pandemic. In 2018 and 2020, the researchers studied 19,108 Americans between the ages of 21 and 62. In 2018, 50% reported being financially stressed and 60% reported being financially anxious.

In 2020, the researchers conducted six focus groups with six participants each. They divided each group by gender and split the groups between young (ages 21 to 34), middle-aged (ages 35-49), and older (ages 50-62).

Here’s what they found:

- Hispanic and Black adults were less likely to experience financial stress than White and Asian adults

- Financial stress appears to decrease the older one gets

- Women are more likely to experience financial stress than men

The report states that some of the main reasons for financial stress are due to:

- Lack of assets

- Too much debt

- Problems with money management, such as using alternative financial services like taking out a payday loan

- Unexpected costs, such as children’s braces

- A lack of financial literacy (1)

For reference, the President’s Advisory Council on Financial Literacy defines “financial literacy” as having the knowledge and skills to effectively manage your financial resources throughout your life. (2)

To determine the financial literacy of participants, the GFLEC researchers used three basic financial literacy questions on interest rate, inflation, and risk diversification. These include the following:

1. “Suppose you had $100 in a savings account and the interest rate was 2% per year. After 5 years, how much do you think you would have in the account if you left the money to grow?”

-

- A) More than $102

- B) Exactly $102

- C) Less than $102

- D) Don’t know

- E) Refuse to answer

2. “Imagine that the interest rate on your savings account was 1% per year and inflation was 2% per year. After 1 year, with the money in this account, would you be able to buy…”

-

- A) More than today

- B) Exactly the same as today

- C) Less than today

- D) Don’t know

- E) Refuse to answer

3. “Do you think the following statement is true or false? Buying a single company stock usually provides a safer return than a stock mutual fund.”

-

- A) True

- B) False

- C) Don’t know

- D) Refuse to answer (3)

Those who answered all the questions correctly, were less likely to report feelings of anxiety and stress when talking and thinking about their finances.

The report concluded that for the majority of participants, COVID-19 didn’t create financial stress — it made existing financial stress worse. This was primarily because of the increase in financial uncertainty during the pandemic in 2020.

Corporate Wellness Expert, Mike Veny

Mike Veny is a corporate wellness specialist, author, and mental health speaker. He took some time to share with us a few tips on financial wellness and how managing your financial stress can benefit your sleep. Check them out!

Financial Stress and Sleep

A good indicator of financial stress is if you’re experiencing stress and anxiety because of your finances, or if you’re worried about financially providing for you and your dependents. (4)

It’s important to note that financial stress can have negative physical effects on the body. For instance, a high level of financial stress can cause headaches, a compromised immune system, high blood pressure, and digestive issues. All these detrimental effects also lead to poorer sleep, which both worsens existing issues and creates new ones. (5) On top of that, financial stress can hurt your psychological health, leading to anxiety and depression, which can also make it harder to get quality sleep. (6)

Let’s take a look at some more ways financial stress can impact sleep.

Insomnia

Financial stress can lead to insomnia, which can become chronic if left unchecked. (7) Insomnia prevents sufferers from sleeping at least seven hours, which is typically considered a full nights’ rest for most adults. (8)

Daniel Ford, former accountant and practicing sleep psychologist at The Better Sleep Clinic, says insomnia typically starts with a stressor, such as financial stress, that can cause you to wake up too early and makes it tough to fall and stay asleep. Mr. Ford notes that insomnia can negatively impact your quality of life and increase your risk of depression.

Anxiety

Mr. Ford says that financial stress can cause anxiety, which can raise your heart rate, body temperature, and activate the “flight or fight” part of your brain. Anxiety works against you at bedtime, since your body needs to be in a relaxed state to fall asleep.

Poor Decision Making

Dr. Brian Wind, Chief Clinical Officer of JourneyPure, says that poor sleep can lead to poor decision-making, such as turning to shopping for short-term relief. This can exacerbate debt problems, which increases your financial stress and makes sleeping even more difficult.

Amelia Alvin, practicing psychiatrist at the Mango Clinic, agrees. She says folks under financial stress can pick up unhealthy habits such as excessive drinking, drug use, and overeating.

Depression and Obesity

According to Mr. Ford, financially stressed college students tend to work more hours, which means they have less time to sleep and are at a greater risk of depression. (9) He also notes that financial stress can impact dietary choices, which can raise the risk of obesity.

Tips to Reduce Financial Stress

How can you reduce your financial stress so you can sleep better? Let’s take a look at some expert tips and research on how to reduce your financial stress.

Practice financial wellness

Financial wellness refers to being financially secure. According to the National Financial Educators Council, it involves the following:

- Having and sticking to a budget (I’ll discuss this in the next section)

- Making sure you are financially prepared for emergencies

- Actively following plans to reach your short-term and long-term goals (10)

So, what does good financial wellness look like? Folks who are financially healthy tend to have low levels of debt and an active savings plan that they follow. (11)

Create a budget

Ben Reynolds, CEO and Founder of Sure Dividend, says you should make a customized budget that you can adjust as necessary. He says this will help you avoid overspending and becoming overwhelmed with debt. To do this well, Mr. Reynolds suggests organizing your bills to decrease your likelihood of missing payment due dates.

Build an emergency fund

Pamela Yellen is a financial expert, New York Times best-selling author, and founder of Bank On Yourself. She recommends building a safe and liquid emergency fund that covers your household expenses for two years. This gives you a cushion in case you have unexpected costs, or you lose your job. An emergency fund can also allow you to take advantage of investment opportunities.

To start saving for an emergency fund, Anthony Martin, CEO & Founder of Choice Mutual recommends writing a list of things you commonly buy that you could get at a reduced price. Next, add up how much you saved by buying those goods at a lower cost and contribute that money toward paying off your debt. He notes that by removing the money at the beginning of the month instead of at the end, you cannot use it to make irresponsible purchases.

Use less than 30% of your credit limit

According to Mr. Reynolds, you can avoid negative impacts on your credit score and save money by maintaining less than 30% of your credit limit. Doing this can help reduce the stress of getting out of credit card debt.

If you use too much of your credit limit, you can incur too much interest. He says this is especially true if you only pay the minimum amount each month.

Use debit cards rather than credit cards

Credit cards are necessary for building a credit score, but they have their drawbacks. Mr. Martin says that if you’re getting into debt by using credit cards, consider switching to debit cards. Since debit cards take the funds directly from your bank account, you can’t run up the debt past a fixed overdraft.

Only invest with expendable funds

Mr. Reynolds says that while it can be beneficial to save and invest in your retirement, you should only do so with money that you can afford to lose. Before you invest in dividend stocks or REITs (real estate investment trusts), he suggests making sure you have enough money to pay your bills. By not paying essential bills, you risk losing your house, and you’re more likely to hit your credit limit or go into debt.

Practice good sleep hygiene

The restorative impact of quality, deep sleep is necessary for a healthy brain. Sleep can reduce your financial stress by allowing your mind to recover. To get the best sleep possible, it’s important that you practice good sleep hygiene.

Here are some best practices for good sleep hygiene:

- Schedule a sleep time and wake time that you stick to throughout the week, even on weekends

- Have a calming bedtime ritual that includes activities such as light reading or meditating

- Keep your bedroom cool and dark

- Use your bedroom only for sex and sleeping

- Exercise during the day to help you sleep well at bedtime

- Avoid looking at a screen at least one hour before bedtime

- Wash/change your bedsheets once a week

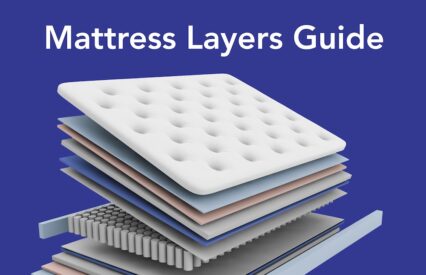

- Pick a mattress that will keep you comfortable without breaking the bank

Last Word From Sleepopolis

Reducing your financial stress and getting quality sleep may take time, but it isn’t impossible. Keep in mind that creating a budget, building an emergency fund, and using debit cards are all ways you can help reduce your financial stress, which in turn can help you achieve better sleep. Please remember that we are not medical or financial experts, so be sure to speak with your healthcare provider if you have any medical questions and speak with a financial professional if you have any financial questions.

References

- Hasler, A et al. Financial Anxiety and Stress among U.S. Households: New Evidence from the National Financial Capability Study and Focus Groups. Global Financial Literacy Excellence Center. Apr 28, 2021.

- “Recommendations to the President.” The President’s Advisory Council on Financial Literacy. 2008. https://www.treasury.gov/about/organizational-structure/offices/Domestic-Finance/Documents/PACFL-recommendations.pdf

- “The Big Three and Big Five.” Global Financial Literacy and Excellence Center. https://gflec.org/education/questions-that-indicate-financial-literacy/

- Nagle, C. “The Mental Impact of Financial Stress and Tips for Dealing with COVID-19 Impacts.” May 15, 2020. https://www.nfcc.org/resources/blog/the-mental-impact-of-financial-stress-and-tips-for-dealing-with-covid-19-impacts

- “Mental well-being inherently connected to financial wellness.” Purdue University. Jan 27, 2021. https://www.purdue.edu/newsroom/purduetoday/releases/2021/Q1/mental-well-being-inherently-connected-to-financial-wellness.html

- Sturgeon, J et al. The psychosocial context of financial stress: Implications for inflammation and psychological health. Psychosomatic Medicine. Mar 2016.

- Han, K et al. Stress and Sleep Disorder. Experimental Neurobiology. Dec 26, 2012.

- Du, C et al. Insufficient Sleep and Poor Sleep Quality Completely Mediate the Relationship between Financial Stress and Dietary Risk among Higher Education Students. Behavioral Sciences. May 5, 2021.

- Peltz, J et al. The Role of Financial Strain in College Students’ Work Hours, Sleep, and Mental Health. Daemen Digital Commons. Jan 15, 2020.

- “Financial Wellness Definition.” National Financial Educators Council. https://www.financialeducatorscouncil.org/financial-wellness-definition/

- Britt, S et al. The Financial Health of Mental Health Professionals. Journal of Financial Therapy. Jul 2015.